PNN

Mumbai (Maharashtra) [India], October 21: Aelea Commodities Limited (BSE: ACLD), one of the leading integrated players in cashew processing announced its unaudited financial results for the first half of FY26.

Operational Highlights

During H1 FY26, the Company maintained robust capacity utilization levels at its Surat plant and advanced preparatory work for Unit III, which will integrate renewable energy generation and by-product valorization into its operations. The upcoming phase targets the conversion of Cashew Nut Shell Liquid (CNSL) into Cardanol, De- oil Cake, and Bio Charcoal, reflecting Aelea's strategic move toward circular economy practices.

Strategic Developments

Unit II in Surat, commissioned in FY25, is now fully operational and supplying domestic markets only.

Land acquisition for Unit III completed, renewable energy integration plans under design.

Value-added product line under the 'Tryble' & 'Supreme' brand continues to gain traction in retail and e-commerce channels.

Global sourcing partnerships strengthened with suppliers across Cote d'Ivoire, Benin, Tanzania, and Indian MNC trading companies etc, ensuring consistent raw material availability.

Commenting on the company's performance in H1 FY26, Mr. Hozefa Shabbir Husain Jawadwala, Chairman and Managing Director of Aelea Commodities Limited, said, "The first half of FY26 marked a phase of strong execution, consolidation, and purposeful scale-building. We focused on optimizing capacity, deepening our sourcing network across Africa, and expanding product applications across food, fuel, feed, and fertility segments. These focused strategic actions have translated into robust operational and financial performance.

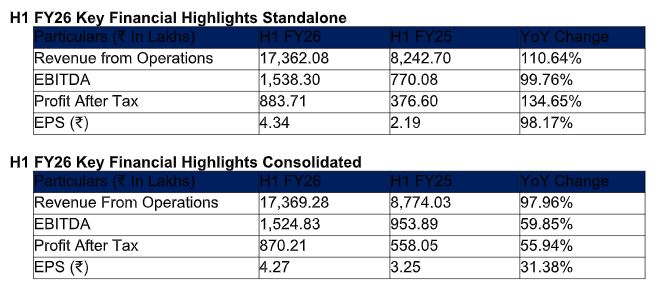

Compared to H1 FY25 standalone, revenue from operations for H1 FY26 stood at ₹17,362.08 lakhs, up 110.64% year-on-year, reflecting sustained growth momentum and improved capacity utilization. EBITDA rose sharply to ₹1,538.30 lakhs, up 99.76% YoY, with an EBITDA margin of 8.86% in H1 FY26, underscoring better operating leverage. PAT delivered a standout performance, more than doubling to ₹883.71 lakhs in H1 FY26, up 134.65% YoY, with a PAT margin of 5.09%, highlighting the success of our strategic initiatives and our ability to scale profitably. EPS stood at ₹4.34, marking a 98.17% YoY growth.

On a consolidated basis, revenue from operations in H1 FY26 stood at ₹17,369.28 lakhs, up 97.96% YoY. EBITDA increased ₹953.69 to ₹1,524.83 lakhs with a margin of 8.78%. PAT rose ₹558.05 to ₹870.21 lakhs with a margin of 5.01%, while EPS improved ₹3.25 to ₹4.27, highlighting sustained profitability.

With a strong first half setting the tone, the company expects to maintain this positive trajectory, further enhancing efficiency and margins in the coming months. Our vision remains clear, to transform Aelea into a diversified agri-value enterprise that combines profitability with purpose, built on a scalable, green, and globally competitive foundation."

Future Outlook

With strong sectoral demand for processed cashews and sustainable agri-products, Aelea is well-positioned for continued growth. The company's focus remains on:

Enhancing margins through value addition and forward integration.

Leveraging automation to improve efficiency and traceability.

Utilizing by-products for renewable energy and specialty chemicals.

About Aelea Commodities Limited

Established in 2018, Aelea Commodities Limited specializes in processing Raw Cashew Nuts (RCN) into high-quality cashew kernels. Under the visionary leadership of Chairman Mr. Hozefa Jawadwala, Aelea has rapidly evolved from a rising enterprise into a defining influence within the commodity landscape.

Anchored in sustainability and innovation, Aelea is advancing plans to convert cashew by-products into biofuels and activated carbon--uniting profitability with environmental responsibility. With capacity expansion from 40 to 140 MTPD, funded by IPO proceeds and driven by strong sectoral demand, the Company is strategically positioned for accelerated growth.

Disclaimer

Certain statements in this document that are not historical facts are forward looking statements. Such forward-looking statements are subject to certain risks and uncertainties like government actions, local, political or economic developments, technological risks, and many other factors that could cause actual results to differ materially from those contemplated by the relevant forward-looking statements. The Company will not be in any way responsible for any action taken based on such statements and undertakes no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same.)